Intercompany Accounting and Best Practices

Larger corporations or businesses that consist of multiple subsidiaries or divisions are required to adhere to the rules of intercompany accounting. This accounting process involves the management of financial transactions between different legal entities within the same parent company.

Intercompany accounting also has applications in companies of all sizes. For example a franchise owner with multiple locations may benefit by treating each as a separate entity. In that case they need intercompany accounting to show the financial position of the business as a whole.

Companies frequently engage in various financial transactions within their parent company, from the allocation of shared costs to inter-divisional sales of goods and services. They can settle the interactions in cash or by journal entry in their general ledgers. This adds layers of complexity that demands careful handling. In this blog, we will explore what intercompany accounting entails and the best practices that can be adopted to ensure accuracy and compliance.

Understanding Intercompany Accounting

At its core, intercompany accounting tracks money movement within a company’s multiple entities. This process is vital because it impacts the company’s consolidated financial statements, which investors, regulators, and other external parties use to assess the company’s overall health and performance.

During the intercompany accounting process, challenges often arise when reconciling accounts for each entity. Discrepancies can occur due to timing differences, exchange rate fluctuations, or simply human error. Such mismatches, if not fixed, can lead to incorrect financial reporting, which in turn can affect a company’s financial integrity.

Types of Intercompany Transactions

The three main types of intercompany transactions are downstream, upstream, and lateral:

Downstream

When a parent company does business with a subsidiary, the transaction flows from the parent company to the subsidiary, and the parent company records the transaction and applicable profit or loss.

Upstream

When an asset moves from the subsidiary to the parent company. Gains or losses from the sale are eliminated during consolidation.

Lateral

When two subsidiaries of the same parent company engage in a transaction. For instance if one subsidiary provided raw materials to another, any intercompany profit would be eliminated.

Intercompany Accounting and The Close

Intercompany accounting and the financial close process often go hand in hand. During the financial close, corporations need to eliminate intercompany transactions to avoid double-counting and accurately present consolidated financial statements. This entails reconciling all accounts between legal entities, eliminating any intercompany transaction balances, and preparing appropriate adjustment for financial consolidation.

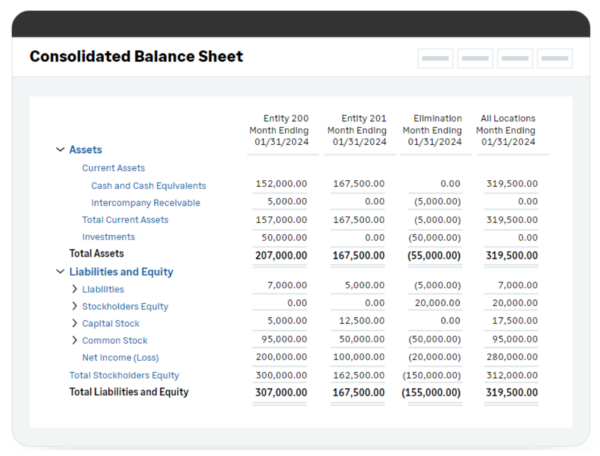

Consolidated Balance Sheet in Sage Intacct

Best Practices for Intercompany Accounting

Properly managing intercompany accounting is key to ensuring transactions are accurately recorded and reconciled, thereby maintaining financial health and compliance. Here are some strategies that finance professionals should consider:

Standardization of Processes

Crafting a standard procedure when intercompany transactions occur can minimize inconsistencies. This ensures all intercompany transactions are executed and recorded uniformly across all divisions.

Use of Technology in Intercompany Accounting

Accounting software like Sage ERP can greatly assist by automating processes, flagging discrepancies, and providing real-time reports. This eliminates the need for manual reconciliation and reduces the chances of human error. Additionally, accounting software can centralize data from multiple entities within the same parent company, making it easier to track and manage intercompany transactions.

For instance with Sage Intacct you can set up, view, and manage all intercompany relationships in one place. Secondly you can automatically create journal transactions between multiple entities, to get a clear, centralized view- saving time and improving accuracy. Thirdly, you can have new entities inherit your existing lists, process definitions, and charts of accounts or configure new entities with unique definitions. Finally, you can centralize accounts payable and receivable or get entity-specific general ledger accounts.

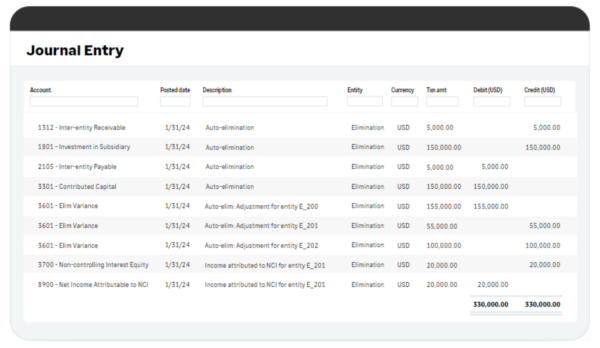

Auto-Eliminations in Sage Intacct

“Before Sage Intacct, we would have to export each entity’s information to Excel to produce consolidating financials. I can’t even quantify the time savings, but it’s enormous.” Alyssa Lare, Priority Management

Centralization of Accounting Functions

A central accounting team dedicated to intercompany transactions can oversee the entire process, ensuring that policies are correctly implemented and intercompany transactions are consistently recorded.

Training and Communication

Regular training sessions for finance staff on the specificities of intercompany accounting processes can prevent errors and misunderstandings.

Clear Intercompany Accounting Agreements

Establish clear, formal agreements between subsidiaries that outline the terms and responsibilities related to intercompany transactions.

Compliance with Regulations

International financial reporting standards (IFRS) and Generally Accepted Accounting Principles (GAAP) provide regulatory frameworks for managing intercompany accounting. Stay up-to-date with these standards and any modifications to ensure compliance.

Consistent Currency Conversion Methods

For international transactions, utilize a consistent method for converting currencies to the reporting currency to avoid discrepancies due to fluctuating exchange rates.

Reponsiveness to Issues

When discrepancies arise, address them immediately. Delays can compound the problem and make the reconciliation process more challenging.

Documentation and Record-Keeping

Maintain thorough records of all transactions, including supporting documents. These records are essential for audit trails and can clarify any questions that might arise about a transaction.

Conclusion

Adhering to robust intercompany accounting practices is an ongoing process and requires diligence, attention to detail, and an openness to adapting as the parent company grows and evolves. Finance professionals have the responsibility to understand these dynamics and to evolve the accounting practices that accompany them. Implementing best practices not only simplifies the accounting process but also ensures that stakeholders have confidence in the company’s financial financial statements. Keep these practices in mind as you manage your company’s finances.

Contact us to learn how Sage Intacct can help your company manage intercompany transactions and simplify other complex processes.

Sage Intacct Cloud Financials