Driving Performance in Financial Services: 3 New Approaches for the Data-Driven Finance Leader

Intuitively, many of us recognize that the decision window for executives has been shrinking with each passing year. Information dissemination has become real-time and on-demand; however, the challenge for many finance functions is to try and keep pace with all the modern sources of insight and analysis that internal and external stakeholders are receiving.

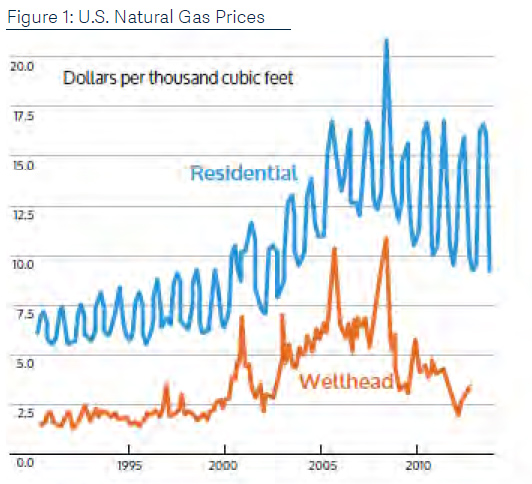

We can layer on an incremental challenge in many industries where the business environment changes more often and more dramatically than ever before as well. Take for instance commodity prices, which have seen increasing levels of volatility in recent years. Imagine you are a company impacted by the price of natural gas (Figure 1) and consider the implications these price swings can have on your business model. That is but one example of a changing strategic driver. Consumer tastes and demands can shift virtually overnight. Everyday, new technologies and new business models replace old technologies and old business models. The luxury of time is something few executives have anymore when it comes to making decisions.

An Aberdeen study found that 64% of business managers have seen their decisionmaking time shrink over the last year. In another study, Aberdeen found that 28% of business managers said they needed data to make decisions within an hour of a business event; another 42% needed information within a day. That doesn’t provide much time for finance to supplement the decision making process with supporting analysis.

Decision-making processes have relied, and should rely, on fact-based, data-driven management information. Historically, executives would depend on monthly financial reports and a plethora of other off-line operational reports originating from outside the finance function to monitor the health of the business. Financial reports and other real-time operational data are often lagging indicators of performance. These metrics, although perhaps lacking precision, may have been sufficiently effective in the past; however, they are less so now because they lag the current cadence of information dissemination and business volatility today. Instantaneous and deeper financial insight is required more than it ever has at any point in history to respond to these challenges. What is required is an analytical approach that enables management to monitor and measure the development of the important strategic drivers and make decisions with confidence. In this whitepaper, we will explore how organizations are transitioning from a periodic, ad hoc reporting paradigm to real-time reporting.