Why Choose Sage Intacct ERP Software for Family Offices

Family offices have unique challenges when it comes to choosing Enterprise Resource Planning (ERP) or financial management software. They need tools that can consolidate data across multiple entities, adapt to changing reporting regulations and protect sensitive financial information. While managing multiple assets and investments, these organizations also need a solution that can grow with their operations. Sage Intacct ERP software is a leading cloud-based solution built specifically for family office wealth management.

What is Sage Intacct ERP Software for Family Offices?

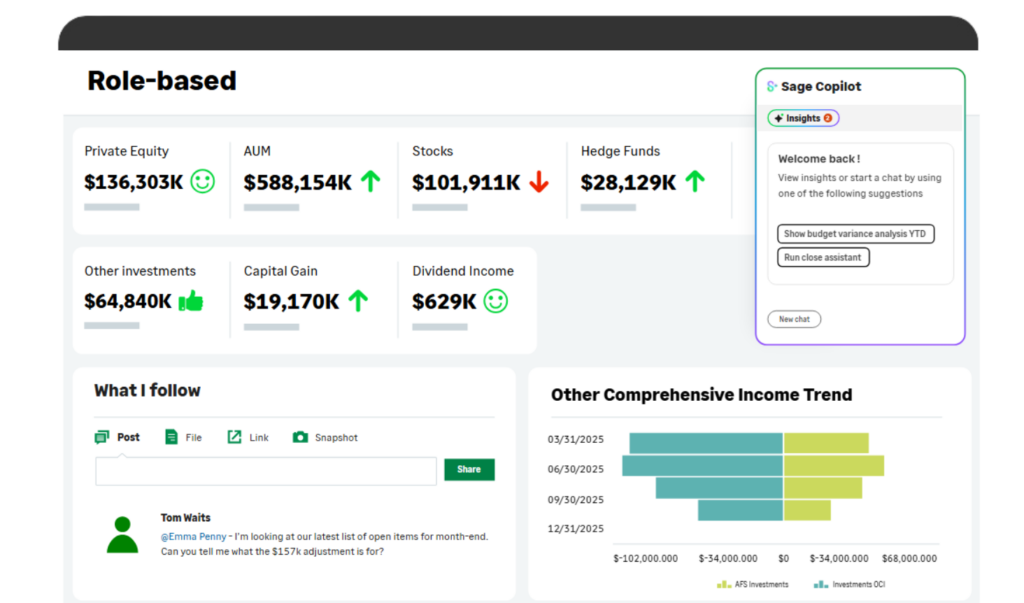

Sage Intacct is an advanced cloud-based ERP software that streamlines accounting and provides deep financial insights through AI-powered automation. Core financial management includes accounts payable and receivable, cash management and advanced reporting and analytics. Built to scale with your business, Sage Intacct integrates with existing operational applications for seamless departmental collaboration.

With real-time data and automation, Sage Intacct helps decision-makers reduce inefficiencies, optimize financial performance and make quick decisions. Trusted across industries, it’s known for its reliability, flexibility and ability to meet the needs of modern financial teams.

Why Choose Sage Intacct ERP Software?

Sage Intacct is designed to give family offices complete financial visibility. It simplifies tracking investments, expenses and multi-entity consolidations, making it the perfect choice for wealth management organizations. The platform is flexible enough to handle complex financial structures and diverse portfolios while maintaining data accuracy and operational efficiency. With robust security features, family offices can have confidence that their information is safe.

By using Sage Intacct ERP for family offices, businesses can streamline operations, save time on manual tasks and focus on delivering long-term value to the families and organizations they serve.

Customized for Complex Financial Management

Family offices manage multiple investments, trusts, estates and personal finances. These intricate structures require precise tracking and reporting to give decision-makers accurate data. Sage Intacct addresses these needs with advanced features including:

- Multi-Entity and Multi-Currency: Automatically consolidate financials across entities and currencies without manual data entry or tedious processing.

- Custom Reporting: Generate detailed custom reports to track key metrics such as investment performance or family goals, transparency and accountability.

- Granular Asset Tracking: Monitor financials and performance of multiple assets, from real estate to private equity holdings.

Secure and Compliant

Given the sensitive nature of family office data, Sage Intacct has robust safeguards to ensure privacy and compliance, including Role-Based Access Controls: Control who can see specific financial data and define their permissions for maximum security.

- Audit Trails: Have full transparency with a detailed log of all transactions to support internal controls and make audits easy.

- Regulatory Compliance: Built to meet U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), Sage Intacct is ideal for family offices with global operations.

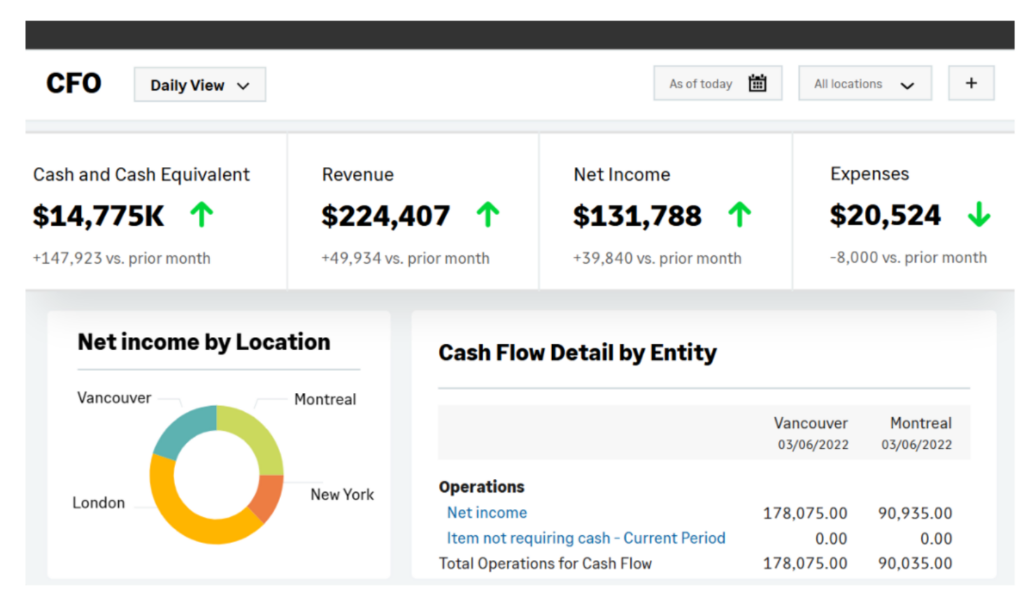

Reporting and Analytics

Sage Intacct’s reporting and analytics capabilities give family offices the ability to generate reports for family members, stakeholders and advisors. Key features include:

- Custom Reports: Create reports on portfolio performance, asset allocation or income distribution to provide valuable insights.

- Real-Time Dashboards: Access financial metrics anytime, anywhere and make data driven decisions.

- Investment Performance Tracking: Track returns and performance across investment categories to monitor family wealth over time.

Multi-Generational Wealth Management

Family offices span multiple generations and require software that can keep up with growing and changing needs. Sage Intacct does this with features like:

- Distribution Tracking: Manage and track distributions to family members for equitable wealth management.

- Legacy and Estate Planning: Simplify management of trust funds, estates and wealth transfers with reporting and tracking tools.

- Multi-Generational Reporting: Generate reports for different generations, from individual financial growth to estate-level tracking.

Partner with MicroAccounting to Get the Most out of Sage Intacct

At MicroAccounting, we are a premier Sage Intacct partner and can deliver tailored solutions to meet your family office’s unique needs. With over 35 years of ERP implementation experience, our consultants will support your team to get the most out of your financial operations. Our best practices and proven methodology will get your team up and running with the system from day one.

Honestly, everything is easier to accomplish in Sage Intacct. Before, we had to go in and out of each company all day long. Every journal entry, every report, every question meant switching accounts. Now we are easily saving a couple of hours of work every day. That’s time we can use for better things. – Renee Davis, Corporate Controller, B-29 Investments. Read the case study

Ready to Enhance Your Financial Management with Sage Intacct?

Sage Intacct is the top accounting and ERP solution for family offices, with advanced capabilities to manage complex financials, track multiple assets and ensure data security. With cloud-based reporting, seamless integrations and robust AI-powered automation, it’s the perfect choice for organizations looking to simplify financial management and drive growth.

Contact us today to learn more about implementing Sage Intacct at your family office and the benefits of cloud-based financial management.