Driving Family Office Performance—3 New Paths for the Data-Driven CFO

As technology evolves family office executives no longer have the luxury of spending time pouring over data before making decisions. With insight and analysis available nearly anytime, anywhere, finance leaders face the challenge of keeping up with the influx of data they receive. As each year passes new technology takes over and external drivers like constantly changing customer demands cause shifts in business models. This leaves executives with an increasingly short decision window.

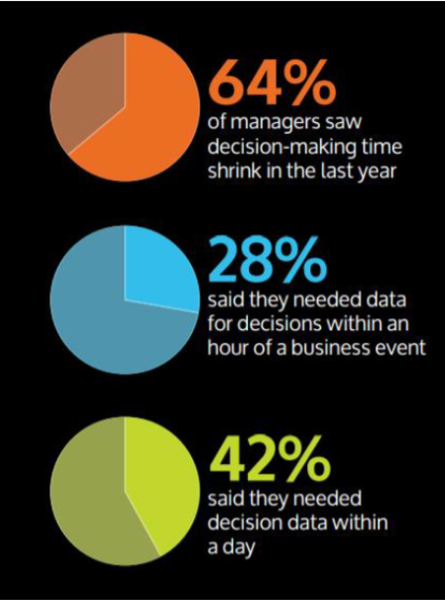

In an Aberdeen study, business managers said they needed to have the data for decision-making within an hour of a business event, while 42% needed it within a day. Such a compressed timeline doesn’t give finance much time to provide the kind of strategic insight that adds value.

Learn how B-29 Investments, a family office, reduced operational efficiencies and gained valuable insight with Sage Intacct. Read the case study: MicroAccounting and Sage Intacct Pay Dividends.

Until quite recently executives would rely on financial reports and operational reports from disparate systems to gauge the health of the family office. While these metrics may have been sufficient at the time, they are often lagging performance indicators. Today’s leaders require immediate insight to respond to business volatility and make confident, strategic decisions. Here, we explore the transition from an ad hoc reporting model to real-time reporting.

Ad hoc reporting fails to fill the gap for family offices

Traditional reporting is aligned to a monthly, quarterly, or annual cycle. Now we recognize that the pace of business is too fast to wait days or even weeks for data. So ad hoc reporting became a way to fill the gap between time lags while also supplementing financial data with operational data. However, ad hoc reports quickly became problematic, lacking in timeliness, consistency, and control.

So if ad hoc reports aren’t the answer, what is? Here are 3 paths to deeper financial analytical insight for family office CFOs

1. Close faster to provide real-time insight to family offices

A faster time to close has been the goal of many finance teams, who want to minimize the time to release financials after period end. It requires a fresh mindset. What if instead of waiting to start the close until the calendar turns, you proactively reviewed and reconciled accounts more frequently – weekly, daily, or by automated integrity checks?

This would allow you to uncover errors sooner and relieve the month-end workload. Even more significant, the family office now has access to reliable data for timely intra-period reporting.

The second component is technology. Deployment of a cloud-based ERP solution allows data to be pulled from multiple entities and sources, a critical requirement for family offices. This speeds up financial reporting by eliminating hand-offs of information.

Since the databases are constantly refreshed, users can run reports more frequently. In turn, frequent reporting relieves pressure of the month-end report, allowing managers to proactively identity and solve problems. This ability improves performance across the organization.

2. Improve analysis by aggregating data from multiple sources

Cloud-based ERP solutions like Sage Intacct overcome many of the challenges inherent in ad hoc reporting. Traditionally, operational data had to be brought in from outside the financial system. A cloud solution integrates data with other disparate systems and updates it in real-time. It can also span multiple entities and geographies effortlessly.

Leading cloud financial solutions have built-in tools for analysis, allowing users to define the reporting timeframe and parameters. Since the tool is built in, these real-time reports are much more reliable than external spreadsheets, never breaking the connection with the underlying data. Plus users can save these as templates and run them at any time without needing to reconcile information from various sources.

3. Implement dashboard reporting to monitor the financial pulse of the family office

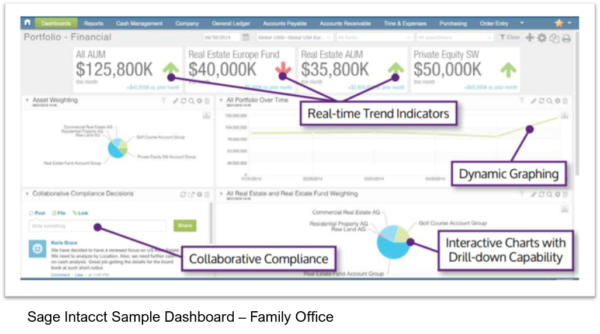

Dashboards are essential to executives, providing high-level snapshots of the health of the business through KPIs. For a truly insightful perspective, KPIs should combine financial and non-financial indicators, with data from inside and outside of the financial system. KPIs vary by organization but most can identify 8-10 that are the main drivers of performance. These become the metrics tracked on the dashboard.

While dashboards have been in use for many years, a modern dashboard is role-based and interactive. It should provide a high-level view of what is relevant to the user while allowing them to drill down into metrics and underlying data. With the ability to source, splice, and drill down to the transactional level, users can understand the cause and effect of decisions or changes to the business.

In fact, dashboards should be the go-to source for decision making. If indicators are outside the acceptable range, these should be obvious. Color scaling, trend indicators, and conditional highlighting all serve to focus attention on areas to drill down further for insight.

Conclusion

As a family office CFO, you decide how to deploy your resources and choose technology. Maintaining a fast-close mindset can help focus on data integrity throughout the period instead of just period end. With this real-time view, opportunities for more frequent, more insightful analysis emerge. A strong analytical tool eliminates the spreadsheet and aggregates multiple sources of data, allowing you to answer all kinds of questions that come up during the day-to-day running of a business. A well-produced dashboard provides control over financial processes and draws attention the most important metrics of your business.

Are your IT and finance teams overwhelmed by ad hoc analysis and lacking the data to make confident decisions? If the answer is yes now is the time to evaluate your reporting systems. Watch this product tour to learn about Sage Intacct for Family Offices.