Process Credit Card Transactions in Intacct

Corporate credit cards can be an accountant’s worst nightmare. Entering and tracking the charges and reconciling that monthly bill can be an incredibly time-consuming process. It can feel like enough of an accomplishment to have charges expensed to the right GL accounts, much less having any record of who you paid without having to track it offline in an Excel spreadsheet. Fortunately, Intacct offers a solution to track and reconcile credit card payments more easily.Here’s how to process credit card transactions in Intacct.

Step 1

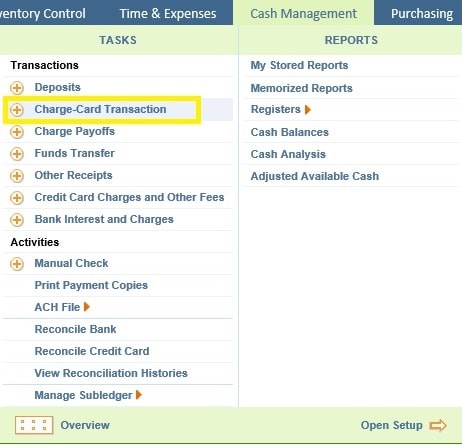

In the Cash Management module, select “Charge-Card Transaction.” (Image 1)

Image 1

Step 2

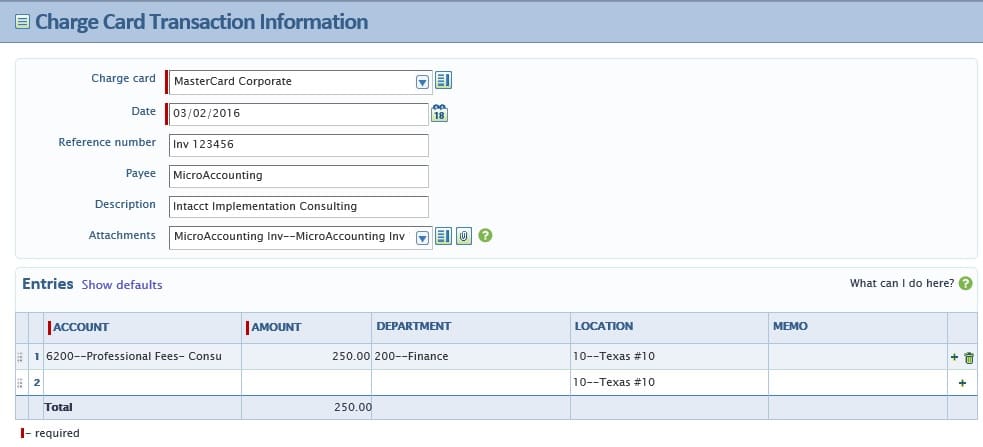

In the “Charge Card Transaction Information” screen, select a charge card from the drop-down menu (Image 2).

You will enter each charge transaction on the credit card. Note the payee, account, and dimensions to code the charge against. You can also choose to include attachments, which gives you a chance to include transaction related back-up data previously saved in the system. Once you have entered the relevant information, save the transaction.

Another option, for easier entry: Import the credit card transactions from a Microsoft Excel template.

Image 2

Step 3

When you receive the credit card statement, you can see all the transactions you have entered against this credit card, and select which ones to include in the payment.

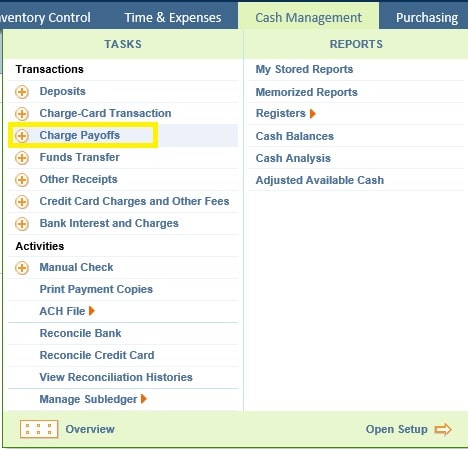

Go to the “Cash Management” module and select “Charge Payoffs.” (Image 3)

Image 3

Step 4

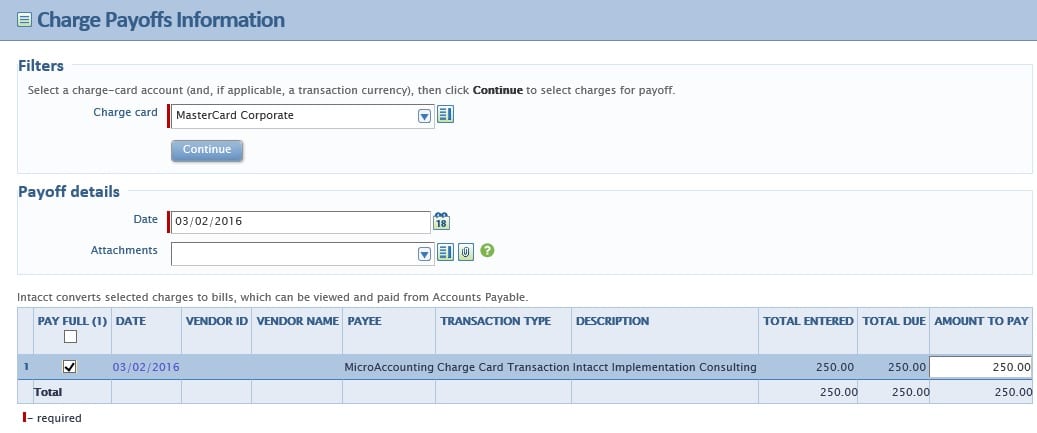

Under Cash Management, in the “Charge Payoffs Information” screen (Image 4), select all the transactions to pay.

Also, choose whether to partially pay a transaction, or pay it in full.

Save your selections to send the charges to Accounts Payable, where a bill will automatically be created. There, you will select the bill to pay.

Image 4

In Intacct, you can also track every credit card charge or fee. This allows you to perform a credit card reconciliation similar to a bank reconciliation so you can complete the entire transaction cycle–enter individual credit card transactions, select transactions to pay, pay the credit card invoice and reconcile the credit card statement.

The best part is all the transactions occur within Intacct so you no longer have to keep track of details outside the system and refer to them when you have to research or reconcile transactions. The ability to add attachments at the transaction level lets you also keep a scanned copy of each credit card receipt with the transaction so all of your documentation is stored in one place.

Intacct sets itself apart from other ERP systems with its enhanced functionality and ease of use, as well as providing a solution for the tasks that are often the most tedious for the accounting department.

Contact us or watch this product tour to learn more about how Intacct can help your business. We look forward to speaking with you.