Save time and money by improving your fixed asset depreciation process

Fixed assets are a critical part of any organization. After all, no matter what you do, every company needs chairs, desks, computers, and filing cabinets. But they can also be a source of frustration and uncertainty. Fixed assets are subject to a host of complicated rules and depreciation methods. And they are often located in multiple geographic locations, making it difficult to know exactly what you have and where.

Fixed asset depreciation – the process of accurately tracking the life cycle of assets and reporting their value for tax and insurance purposes – is a critical function in any business. But many companies struggle with establishing an effective approach. For starters, it can be difficult to know exactly which fixed assets you have on the books, and where they’re located. Without a full understanding of your fixed assets, it’s impossible to accurately calculate depreciation. This can lead to paying more than necessary in taxes and insurance premiums, since those costs are calculated based on the value of your assets.

Many businesses attempt to manage this complex situation using spreadsheets and other manual processes. This creates a complicated and time-consuming problem for finance employees who already have a lot on their hands – and who could be using their time for more productive tasks. Employees from other departments often get pulled into the process, impacting productivity for the entire organization. In addition, gaps in your fixed asset depreciation process can call the accuracy of all your financial reports into question. And a lack of understanding of exactly what assets you have and where they are makes it easier for assets to go missing or even be stolen.

The good news is that there is a more effective and efficient way to manage your fixed asset depreciation. A fixed asset tracking solution like Sage Fixed Assets can help you streamline and automate both your tracking and depreciation. With the right platform you can:

- Create a complete inventory of your assets

Fixed asset tracking software simplifies the process. Barcode readers allow you to build a complete inventory – even if your fixed assets are in multiple locations – and store and reconcile the records in a central location. This eliminates manual and duplicate data entry, saving your staff time.

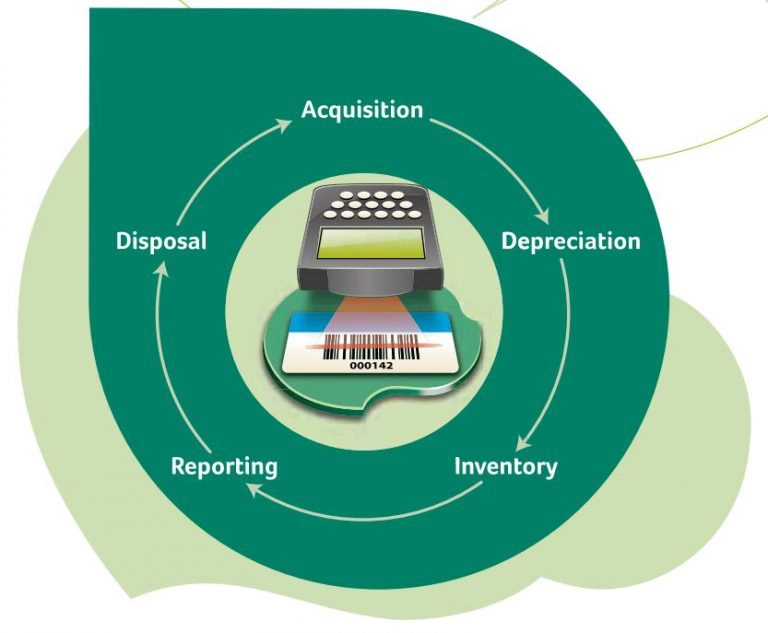

- Streamline the fixed asset life cycle

It can be tricky to manage the life cycle of your assets, including determining the best depreciation method to apply to each one. Sage Fixed Assets can help with depreciation calculation, cost allocation, and even producing year-end financial reports.

- Eliminate spreadsheets and information silos

With fixed asset tracking software, you no longer need to rely on cumbersome spreadsheets and manual processes to track your fixed assets. And cloud-based functionality means that all your asset information is in one place, so that your staff doesn’t have to waste time trying to hunt down information from multiple sources.

Fixed asset tracking software like Sage Fixed Assets can help you improve your asset depreciation process, resulting in cost savings and enhanced productivity. To find out more about MicroAccounting and our robust solutions, including Sage Fixed Assets, call us today at 855-876-3773.