How to Take your Franchise Operations to the Next Level

Franchise operations, particularly multi-entity franchisees, face many financial management challenges. As you add locations, it becomes more and more difficult to provide insight and find growth opportunities. But the pressure is on—to deliver faster closes, deeper analysis, and clean audits.

As your franchisee operation started out, entry-level accounting software may have met your needs. However, as you grow the system can’t scale up. If outdated software is holding you back, it’s time for a solution with the power to transform how you operate.

Leaving spreadsheets behind

When your company was started you may have relied on spreadsheets for reporting and financial close. But as you add locations they become less and less effective. Relying on manual spreadsheets for tasks like multi-unit consolidations and cash flow management results in lost productivity, questionable accuracy, delays in delivering insights, and the risk of unfavorable audits.

Successful franchise CFOs are quickly recognizing these drawbacks and replacing spreadsheets with flexible, true cloud-based solutions like Sage Intacct. With Sage Intacct, finance is able to automate financial processes, even complex ones like procurement and intercompany transactions. Automation increases efficiency and leads to faster delivery of critical financial information and clean audits.

Accurate, real-time financial reporting and in-depth insights

As your operation grows, insightful analysis becomes more critical. You need accurate, timely, and detailed information to understand performance. Without the right tools, this becomes not only time-consuming but results in reports that are out of date and out of step.

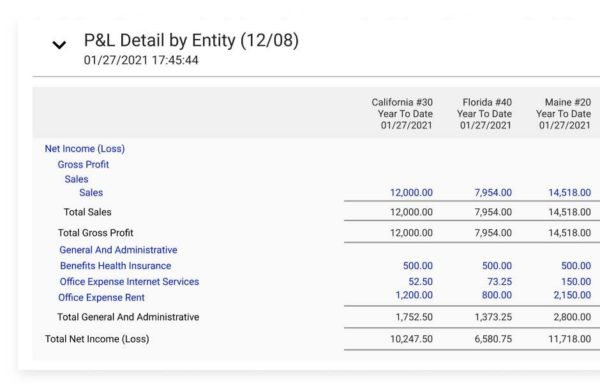

Sage Intacct provides real-time reporting and analytics, so you have insight into performance across your operation. You can respond to questions with confidence, using reports and dashboards that deliver the exact information owners, lenders, and other stakeholders demand.

Faster franchise consolidations and closes

Getting a clear picture of your operation is a challenge to growing franchisees, particularly those with multiple entities and locations. When you’re relying on spreadsheets, it takes a significant amount of time and resources to bring financial data together into one unified view. As a result the closing cycle—which may include converting currencies and performing intercompany eliminations—becomes longer as you grow. Sage Intacct simplifies managing multiple locations, with a single chart of accounts that provides faster consolidation and a more efficient close.

You can toggle between a unified view and unit-specific performance for detailed insight into the corporation and each location. It’s easy to compare the performance of individual locations, including sales categories and time. This ability to continuously compare performance gives you up-to-date insights. It also helps you take advantage of business opportunities and quickly identify and fix problems as they come up.

A new level of speed and flexibility

Every franchisee is unique, so one-size-fits-all financial management software doesn’t meet specialized needs. On-premise software often means a major infrastructure investment, long implementations, and static configurations, with infrequent enhancements and new functionality.

Franchise operations are constantly changing and on-premise systems don’t provide the agility to adapt to growth and change. By moving to the cloud you eliminate infrastructure costs and reliance on IT, while experiencing the benefits of modern, true cloud solutions: lower costs, greater security, and improved productivity.

A key benefit setting cloud apart from on-premise systems is quarterly, automatic updates, which eliminate costly, disruptive upgrades and guarantee your technology is always up to date. Keep up with changing requirements by configuring your system so you have the exact reports and analysis you need. As you add locations you’re using the same chart of accounts and vendors, making it easy to scale up. With Sage Intacct, instead of managing upgrades and costly infrastructure you’ll have software management and infrastructure for one, consistent monthly fee.

Easily integrate applications across your franchise operation

Without the ability to easily share data across your company you can’t operate efficiently. For the full financial picture you need quick access to sales, payroll, budgeting, and other areas across your business. Accomplishing this means having the flexibility to integrate best-in-class applications like Salesforce.

You can tailor your workflows with Sage Intacct because it easily integrates with applications used across your business. Instead of being constrained by integration capability, you can add applications via built in connectors for popular applications like POS and payroll. Or you can create your own automated integration using our Web services API. Either way, this two-way integration gives you the flexibility to customize your connections to work with existing workflows and processes.

As a result, you’ll eliminate redundant data entry, improve productivity, and most importantly get a view of performance across your operation, from sales and forecasting to customer service and marketing.

Sage Intacct—Financial management that helps franchises thrive

A growing number of franchisees are switching from the limitations of outdated software to Sage Intacct’s modern cloud-based solution. Sage Intacct helps you move beyond the constraints and inflexibility of legacy accounting solutions with a powerful cloud financial management and accounting system for growing franchise operations. Maybe that’s why Sage Intacct customers achieve, on average, a 250 percent ROI and a payback period of less than six months.

Read the whitepaper The Insider’s Guide to Franchise Financial Management to learn more.