10 Tips for Preparing for a Successful Audit

You can leverage Sage Intacct to help your audit run smoothly

You are anxiously closing your books out, making sure your debits and credits are balanced, searching for missing invoices, and organizing your financials. You have a nervous look in your eye as you check your watch and your bank account. This audit season, there’s no need for such a frenzied state.

These ten tips will help you prepare for your audit, save you time and money, and leverage your Sage Intacct platform.

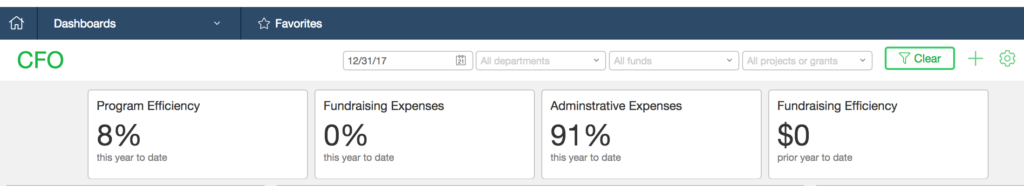

Tip 1. Look at the Big Picture

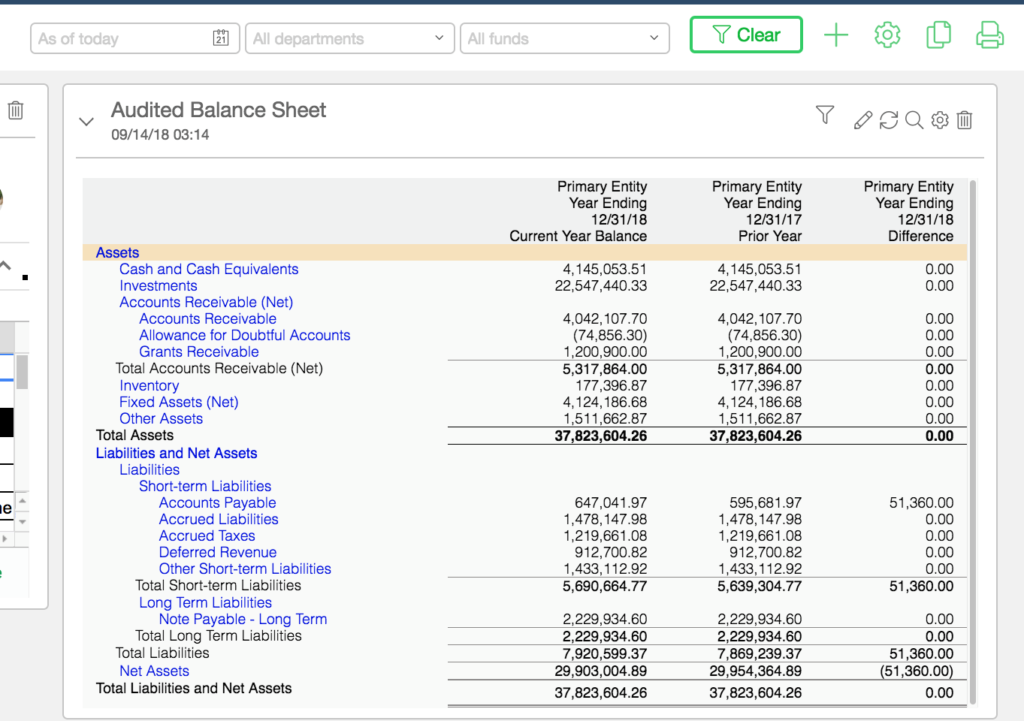

Take a look at your financial statements from a bigger viewpoint – your auditor’s perspective. Start by looking back at the previous year – review the audit adjustments to ensure entries were properly posted and revisit the internal closing comments. Then make preliminary statements and prepare a variance analysis.

Sage Intacct Tip: Filter your dashboard to the prior year to easily filter all your financial reports with one click.

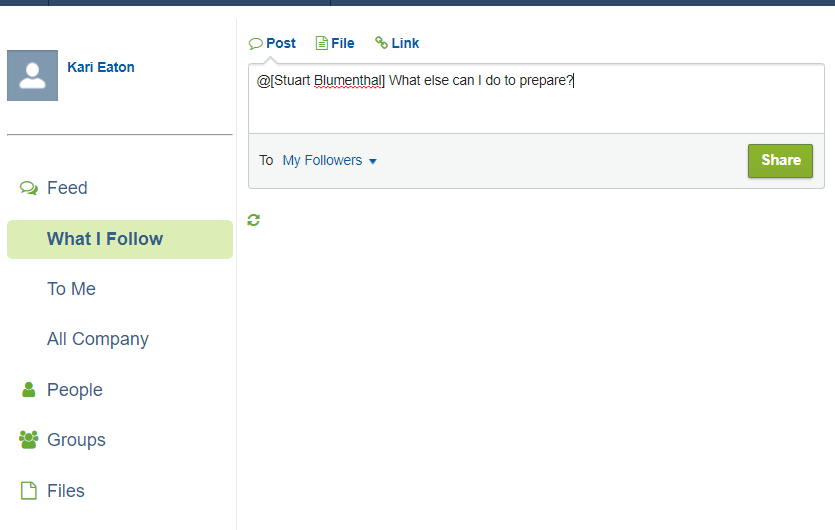

Tip 2. Auditor Communication

Communicate early and often with your auditors! Be sure you have a plan for the upcoming audit. Stay three steps ahead of your auditor. Ask questions. Your auditors are there as a resource for you, so use them – ask about their risk assessment and audit strategy so you are better prepared and informed.

Sage Intacct Tip: Find out the name of your auditor and grant him access to your books. Utilize your Collaborate feed to have internal discussions on activity.

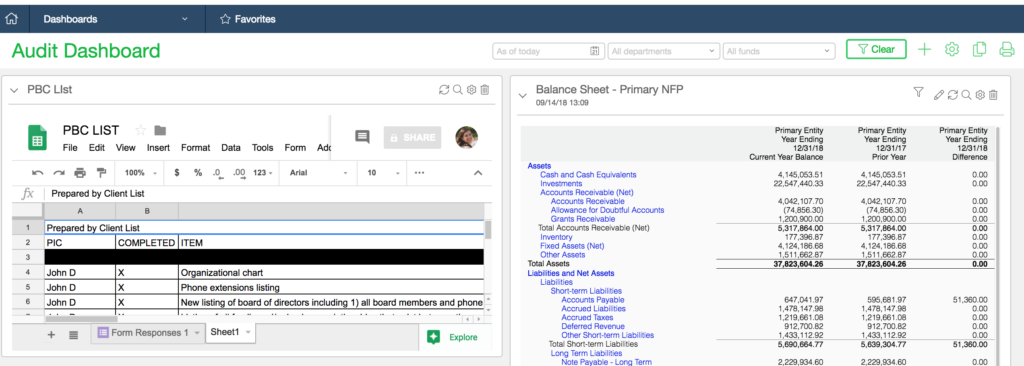

Tip 3. Compare and Coordinate

Ask for a PBC list. Connect the audit list to the internal closing list. Set a timeline of due dates and delegate tasks to employees. Designate an auditing checklist supervisor to monitor the tasks and to have another set of eyes checking to make sure the work is being completed accurately.

Sage Intacct Tip: Create an audit dashboard to house all the reports the auditors need.

Tip 4. Use a Project Management Tool to Share Information

Keep yourself organized. Create an electronic checklist accessible to departments, incorporating your due date and timeline. Utilize a project management platform like Smartsheet to send and receive information to the auditor. Don’t rely solely on emails; information could get lost in the inbox.

Tip 5. New Agreements

Make copies of any new agreements and/or organization documents. Tie down all loose ends related to these documents. Over-inform your team.

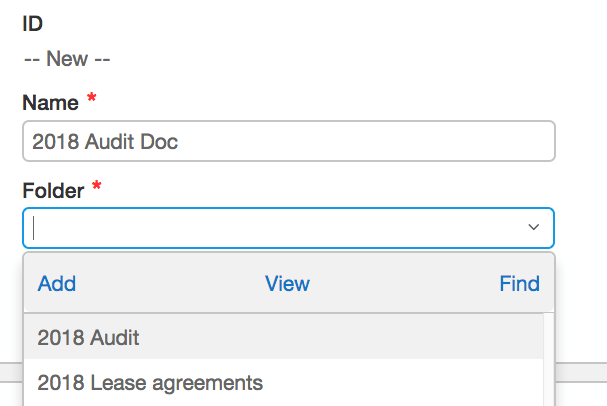

Tip 6. Reconciliations, Source Documents, and Review

Complete year-end reconciliations and conduct a pre-audit of your books. Ensure that amounts reconcile to the trial balance. Assess your financial statements for overall reasonableness. Dig into anything that looks like it could be a red flag and ensure you have proper documentation.

Sage Intacct Tip: Utilize the attachment folders in your Sage Intacct platform to store source documents like bank statements, receipts, and other supporting documentation right in the journal entries.

Tip 7. Be Available During Fieldwork

Ensure key players have appropriate time blocked off during fieldwork. Consider postponing noncritical meetings and declining nonurgent time off requests. Have brief status update meetings with the auditors throughout the process to ensure they are not waiting on you for any information that could delay the end of your audit.

Sage Intacct Tip: Be sure key players and your auditors have appropriate access to Sage Intacct, your project management sheet, online document storage, and any in-house files needed. Double check with your Sage Intacct VAR partner for availability during fieldwork if assistance will be needed in auditing your platform.

Tip 8. Final Analytics

Prepare final analytic procedures and delegate this process to your controller or senior accountant. Review and expand the explanations. Variances should include key metrics that are auditable or can be substantiated by other data.

Sage Intacct Tip: Consider adding new metrics to your dashboards to review during the new year.

Tip 9. Release and Respond

Transmit financial statements and disclosures to the auditors before they leave their fieldwork. Respond in a timely manner to questions and additional requests from the auditors.

Sage Intacct Tip: Add the updated financials to the auditor dashboards.

Tip 10. In/Out

Create and communicate expectations both internally and externally. Have all final documents and sample transactions ready for the auditors. If there are open items after fieldwork, have clear due dates and assign personnel to the tasks. Plan an exit conference with the audit partner to review preliminary findings.

Sage Intacct Tip: Now’s the time to circle back with your Sage Intacct partner to discuss platform changes or workflow enhancements for the new year. Continue improving your system and processes to make next year’s audit even better!

Consider these tips while preparing for the 2018 year-end closing. And take note of the changes you can implement early next year to make the 2019 year-end closing that much easier!